Regression

Introduction

Regression analysis is a conceptually simple method for investigating functional relationships between variables. The relationship is expressed in the form of an equation or a model connecting the response or dependent variable and one or more explanatory or predictor variables.

We denote the response variable by

The general regression model is specified as:

An example is the linear regression model:

where

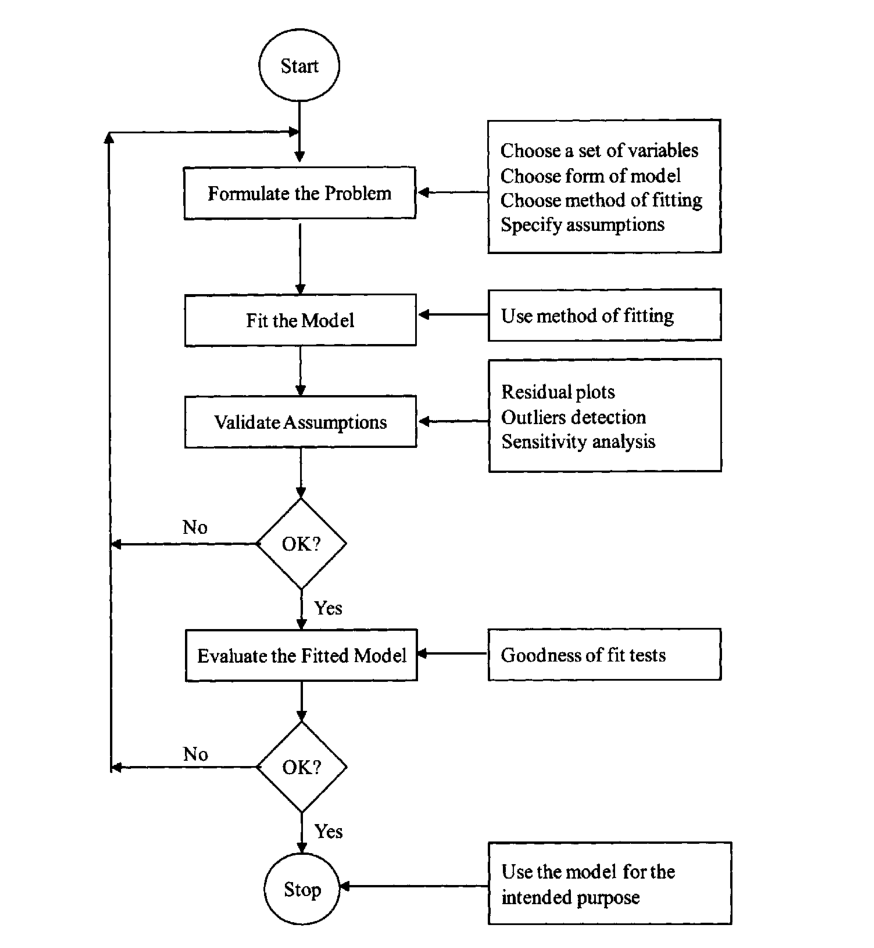

Steps in Regression Analysis

1. Statement of the problem

Formulation of the problem includes determining the questions to be addressed.

2. Selection of Potentially Relevant Variables

We select a set of variables that are thought by the experts in the area of study to explain or predict the response variable.

Each of these variables could be qualitative or quantitative. A technique used in casse where the response variable is binary is called logistic regression. If all predictor variables are qualitative, the techniques used in the analysis of the data are called the analysis of variance techniques. If some of the predictor variables are quantitative while others are qualitative, regression analysis in these cases is called the analysis of covariance.

| Type | Conditions |

|---|---|

| Univariate | Only 1 quantitative RV |

| Multivariate | 2 or more quantitative RV |

| Simple | Only 1 predictor variable |

| Multiple | 2 or more predictor variables |

| Linear | All parameters enter the equation linearly, possibly after transformation of the data |

| Non-linear | The relationship between the response and some of the predictors is non-linear (no transformation to make parameters appear linearly) |

| Analysis of variance | All predictors are qualitative variables |

| Analysis of covariance | Some predictors are quantitative variables, others are qualitative |

| Logistic | The RV is qualitative |

3. Model specification

The form of the model that is thought to relate the response variable to the set of predictor variables can be specified initially by experts in the area of study based on their knowledge or their objective and/or subjective judgments.

We need to select the form of the function

4. Method of Fitting

We want to perform parameter estimation or model fitting after defining the model and collecting the data. the most commonly used method of estimation is called the least squares method. Other estimation methods we consider are the maximum likelihood method, ridge regression and the principal components method.

5. Model Fitting

The estimates of the regression parameters

6. Model Criticism and Selection

The validity of statistical methods depend on certain assumptions, about the data and the model. We need to address the following questions:

- What are the required assumptions?

- For each of these assumptions, how do we determine if they are valid?

- What can be done in cases where assumptions do not hold?

Figure 1: Flowchart illustrating the dynamic iterative regression process

Simple Linear Regression

Simple linear regression is a straightforward approach for predicting

a quantitative response

We describe this as regressing

We wish to measure both the direction and strength of the relationship

between

We use our training data to produce estimates

Let

The least squares approach chooses

If

where

We need to assess the accuracy of our estimates. How far off will a

single estimation of

where

Standard errors can be used to compute confidence intervals. A 95%

confidence interval is defined as a range of values such that with 95%

probability, the range will contain the true unknown value of the

parameter. For linear regression, the 95% confidence interval for

Standard errors can also be used to perform hypothesis tests on the coefficients. The most common hypothesis test involves testing the null hypothesis of:

versus the alternative hypothesis:

To test the null hypothesis, we need to determine whether

which measures the number of standard deviations that

It is a simple matter to compute the probability of observing any

number equal to

Assessing the accuracy of the model

Once we have rejected the null hypothesis in favour of the alternative hypothesis, it is natural to want to quantify the extent to which the model fits the data.

Residual Standard Error (RSE)

After we compute the least square estimates of the parameters of a linear model, we can compute the following quantities:

A fundamental equality in both simple and multiple regressions is

given by

The RSE provides an absolute measure of lack of fit of the model to

the data. But since it is measured in the units of

where

Note that the correlation coefficient

Multiple Linear Regression

We can extend the simple linear regression model to accommodate multiple predictors:

We choose

Unlike the simple regression estimates, the multiple regression coefficient estimates have complicated forms that are most easily represented using matrix algebra.

Interpreting Regression Coefficients

First, it may be interpreted as the change in

Centering and Scaling

The magnitudes of the regression coefficients in a regression equation depend on the unit of measurements of the variables. To make the regression coefficients unit-less, one may first center or scale the variables before performing regression computations.

When dealing with constant term models, it is convenient to center and scale the variables, but when dealing with no-intercept models, we need only to scale the variables.

A centered variable is obtained by subtracting from each observation

the mean of all observations. For example, the centered response

variable is

The centered variables can also be scaled. Two types of scaling are usually performed: unit-length scaling and standardizing.

Unit-length scaling of response variable

where:

The quantities

Unit length scaling has the following property:

The second type of scaling is called standardizing, which is defined by:

where

Since correlations are unaffected by centering or scaling, it is sufficient and convenient to deal with either unit-length scaled or standardized models.

Properties of Least-square Estimators

Under certain regression assumptions, the least-square estimators have the following properties:

-

The estimator

-

The estimator

-

-

The vector

Important Questions in Multiple Regression Models

We can answer some important questions using the multiple regression model:

1. Is there a relationship between the response and the predictors?

The strength of the linear relationship between

A quantity related to

If we do a hypothesis test on

which has a Stundent’s t-distribution with

If we are comparing

If the linear model is correct, one can show that:

and that provided

Hence, when there is no relationship between the response and the

predictors, one would expect the F-statistic to be close to 1. if

2. Deciding on important variables

It is possible that all of the predictors are associated with the

response, but it is more often the case that the response is only

related to a subset of the predictors. The task of determining which

predictors are associated is referred to as variable selection.

Various statistics can be used to judge the quality of a model. These

include Mallow’s

There are

- Forward selection: We begin with the null model – a model that contains an intercept but no predictors. We then fit p simple linear regressions and add to the null model the variable that results in the lowest RSS. We then add to that model the variable that results in the lowest RSS for the new two-variable model, and repeat.

- Backward selection: We start with all variables in the model, andd remove the variable with the largest p-value – that is the variable that is the least statistically significant. The new (p-1)-variable model is fit, and the variable with the largest p-value is removed, and repeat.

- Mixed selection. This is a combination of forward and backward-selection. We once again start with the null model. The p-values of the variables can become larger as new variables are added to the model. Once the p-value of one of the variables in the model rises above a certain threshold, they are removed.

3. Model Fit

Two of the most common numerical measures of model fit are the RSE

and

It turns out that

4. Predictions

Once we have fit the multiple regression model, it is straightforward

to predict the response

- The coefficient estimates

That is, the least squares plane:

is only an estimate for the true population regression plane:

This inaccuracy is related to the reducible error. We can compute a

confidence interval in order to determine how close

-

In practice, assuming a linear model for

-

Even if we knew

Qualitative Variables

Thus far our discussion had been limited to quantitative variables. How can we incorporate qualitative variables such as gender into our regression model?

For variables that take on only two values, we can create a dummy variable of the form (for example in gender):

and use this variable as a predictor in the equation. We can also use the {-1, 1} encoding. For qualitative variables that take on more than 2 values, a single dummy variable cannot represent all values. We can add additional variables, essentially performing a one-hot encoding.

Extending the Linear Model

The standard linear regression model provides interpretable results and works quite well on many real-world problems. However, it makes highly restrictive assumptions that are often violated in practice.

The two most important assumptions of the linear regression model are that the relationship between the response and the predictors are:

- additive: the effect of changes in a predictor

- linear: the change in the response

How can we remove the additive assumption? We can add an interaction

term for two variables

We can analyze the importance of the interaction term by looking at its p-value. The hierarchical principle states that if we include an interaction in a model, we should also include the main effects, even if the p-values associated with their coefficients are not significant.

How can we remove the assumption of linearity? A simple way is to use polynomial regression.

Potential Problems

When we fit a linear regression model to a particular data set, many problems may occur. Most common among these are the following:

- Non-linearity of the response-predictor relationships

- Correlation of error terms

- Non-constant variance of error terms

- Outliers

- High-leverage points

- Collinearity

Non-linearity of the Data

The assumption of a linear relationship between response and

predictors aren’t always true. Residual plots are a useful graphical

tool for identifying non-linearity. This is obtained by plotting the

residuals

If the residual plots show that there are non-linear associations in

the data, then a simple approach is to use non-linear transformations

of the predictors, such as

Correlation of Error Terms

An important assumption of the linear regression model is that the

error terms,

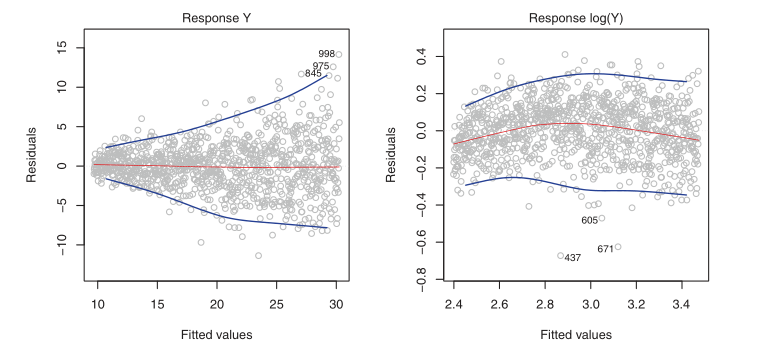

Non-constant Variance of Error Terms

Variances of the error terms may increase with the value of the response. One can identify non-constant variances in the errors, or heteroscedasticity, from the presence of a funnel shape in the residual plot.

Figure 2: Left: the funnel shape indicates heteroscedasticity, Right: the response has been log transformed, and there is now no evidence of heteroscedasticity

Outliers

An outlier is a point from which

Residual plots can clearly identify outliers. One solution is to simply remove the observation, but care must be taken to first identify whether the outlier is indicative of a deficiency with the model, such as a missing predictor.

High Leverage Points

Observations with high leverage have an unusual value for

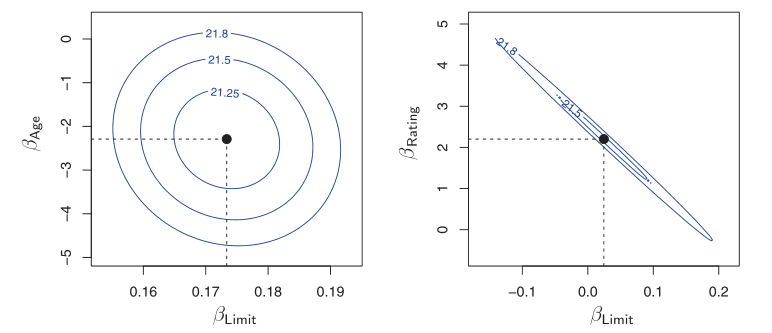

Collinearity

Collinearity refers to the situation in which two or more predictor variables are closely related to one another. The presence of collinearity can pose problems in the regression context: it can be difficult to separate out the individual effects of collinear variables on the response. A contour plot of the RSS associated with different possible coefficient estimates can show collinearity.

Figure 3: Left: the minimum value is well defined, Right: because of collinearity, there are many pairs

Another way to detect collinearity is to look at the correlation matrix of the predictors. An element of this matrix that is large in absolute value indicates a pair of highly correlated variables, and therefore a collinearity problem in the data.

Not all collinearity problems can be detected by inspection of the

correlation matrix: it is possible for collinearity to exist between

three or more variables even if no pairs of variables has a

particularly high correlation. This situation is called

multicollinearity. We instead compute the variance inflation factor

(VIF). The VIF is the ratio of the variance of

where

The data consists of

Linear Basis Function Models

We can extend the class of models by considering linear combinations of fixed non-linear functions of the input variables, of the form:

There are many choices on non-linear basis functions, such as the Gaussian basis function:

or the sigmoidal basis function:

Regression Diagnostics

In fitting a model to a given body of data, we would like to ensure that the fit is not overly determined by one or a few observations. The distribution theory, confidence intervals, and tests of hypotheses are valid and have meaning only if the standard regression assumptions are satisfied.

The Standard Regression Assumptions

Assumptions about the form of the model: The model that relates the

response

which implies that the ith observation can be written as:

Checking the linearity assumption can be done by examining the scatter

plot of

Assumptions about the errors: The errors

-

The error

-

The errors

-

The errors

-

The errors

Assumption about the predictors: Three assumptions are made here:

-

The predictor variables

-

The values

-

The predictor variables

Assumption about the observations: All observations are equally reliable and have an approximately equal role in determining the regression results.

A feature of the method of least squares is that minor violations of the underlying assumptions do not invalidate the inferences or conclusions drawn from the analysis in a major way. However, gross violations can severely distort conclusions.

Types of Residuals

A simple method for detecting model deficiencies in regression analysis is the examination of residual plots. Residual plots will point to serious violations in one or more of the standard assumptions when they exist. The analysis of residuals may lead to suggestions of structure or point to information in the data that might be missed or overlooked if the analysis is based only on summary statistics.

When fitting the linear model to a set of data by least squares, we obtain the fitted values:

and the corresponding ordinary least squares residuals:

The fitted values can also be written in an alternative form as:

where the

In multiple regression the

The value

When the standard assumptions hold, the ordinary residuals,

To over come the problem of unequal variances, we standardize the ith

residual

This is called the ith standardized residual because it has mean zero

and standard deviation 1. The standardized residuals depend on

An alternative unbiased estimate of

where

Using

which we term the internally studentized residual. Using teh other unbiased estimate, we get:

which is a monotonic transformation of

The externally standardized residuals follow a t-distribution with n - p - 2 degrees of freedom, but the internally standardized residuals do not. However, with a moderately large sample, these residuals should approximately have a standard normal distribution. The residuals are not strictly independently distributed, but with a large number of observations, the lack of independence may be ignored.

Graphical methods

Before fitting the model

Graphs plotted before fitting the model serve as exploratory tools. There are four categories of graphs:

1. One-dimensional graphs

One-dimensional graphs give a general idea of the distribution of each individual variable. One of the following graphs may be used:

- histogram

- stem-and-leaf display

- dot-plot

- box-plot

These graphs indicate whether the variable is symmetric, or skewed. When a variable is skewed, it should be transformed, generally using a logarithmic transformation. Univariate graphs also point out the presence of outliers in the variables. However, no observations should be deleted at this stage.

2. Two-dimensional graphs

We can take the variables in pairs and look at the scatter plots of

each variable versus each other variable in the data set. These

explore relationships between each pair of variables and identify

general patterns. These pairwise plots can be arranged in a matrix

format, known as the draftsman’s plot or the plot matrix. In simple

regression, we expect the plot of

Beyond these, there are rotation plots and dynamic graphs which serve as powerful visualizations of the data in more than 2 dimensions.

Graphs after fitting a model

The graphs after fitting a model help check the assumptions and assess the adequacy of the fit of a given model.

- Graphs checking linearity and normality assumptions

When the number of variables is small, the assumption of linearity can be checked by interactively and dynamically manipulating plots discussed in the previous section. However, this quickly becomes difficult with many predictor variables. Plotting the standardized residuals can help check the linearity and normality assumptions.

-

Normal probability plot of the standardized residuals: This is a plot of the ordered standardized residuals versus the normal scores. The normal scores are what we would expect to obtain if we take a sample of size

-

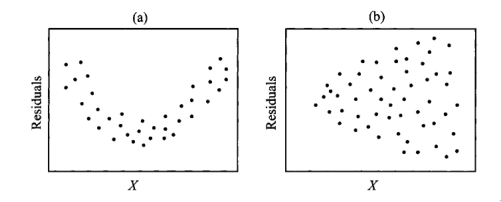

Scatter plots of the standardized residual against each of the predictor variables: Under the standard assumptions, the standardized residuals are uncorrelated with each of the predictor variables. If the assumptions hold, the plot should be a random scatter of points.

-

Scatter plot of the standardized residual versus the fitted values: Under the standard assumptions, the standardized residuals are also uncorrelated with the fitted values. Hence, this plot should also be a random scatter of points.

-

Index plot of the standardized residuals: we display the standardized residuals versus the observation number. If the order in which the observations were taken is immaterial, this plot is not needed. However, if the order is important, a plot of the residuals in serial order may be used to check the assumption of the independence of the errors.

Figure 4: Scatter plots of residuals: (a) shows nonlinearity, and (b) shows heterogeneity

References

, Chatterjee and Hadi, n.d., @james2013introduction